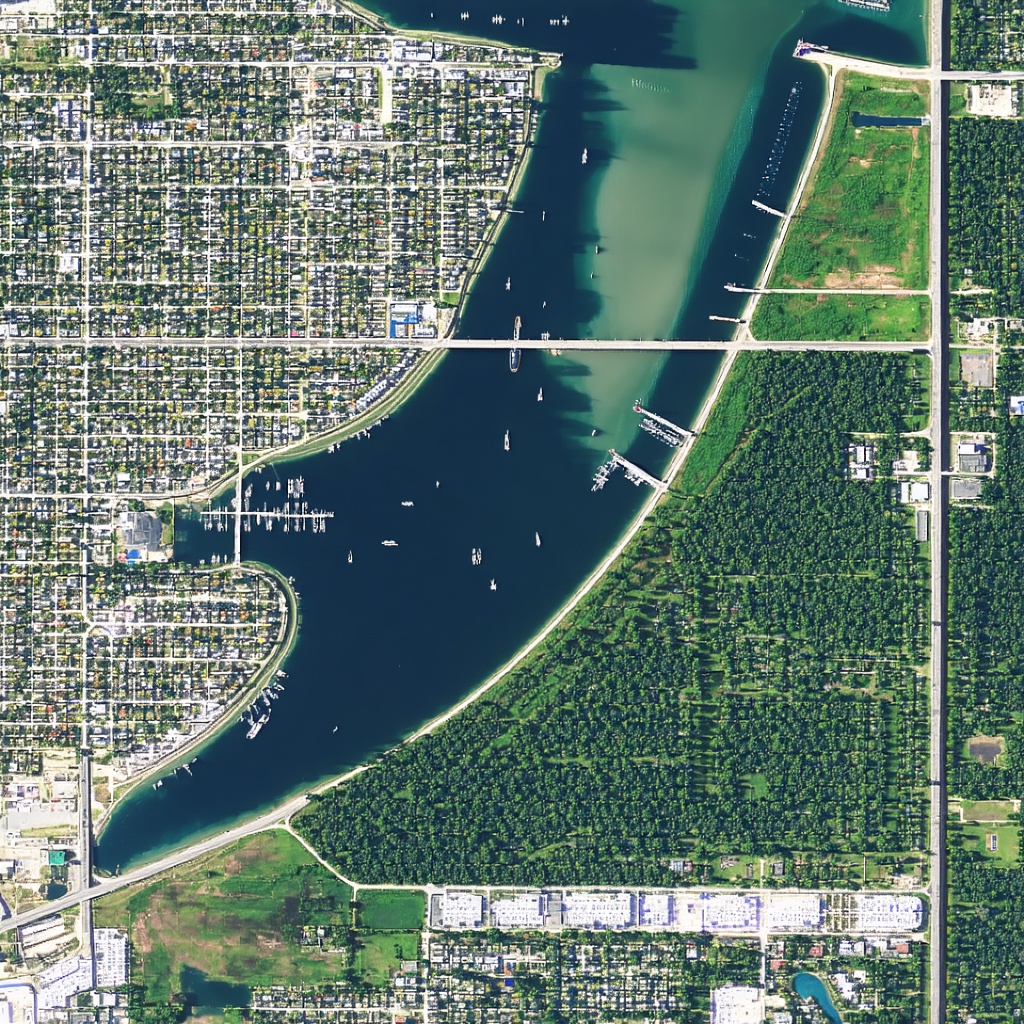

Welcome to the sunny shores of Southwest Florida, where the warm climate and beautiful scenery create the perfect backdrop for real estate opportunities. As the real estate market in this vibrant region continues to flourish, we find ourselves at an exciting crossroads where building a successful portfolio can pave the way for financial security and growth. At SWFL Commercial Group, we are dedicated to helping our clients navigate this ever-evolving landscape, ensuring that each investor can create a diversified portfolio that aligns with their goals and aspirations.

Creating a Diversified Real Estate Portfolio: How and Why?

When it comes to investing in real estate, diversification is key. Just as we wouldn’t put all our eggs in one basket when it comes to stocks or bonds, the same principle applies to real estate investments. A diversified portfolio allows us to mitigate risks while maximizing potential returns. But how do we go about creating this multifaceted portfolio? The first step is understanding the different types of real estate assets available to us. From residential properties to commercial spaces, and even mixed-use developments, each type offers unique benefits and challenges.

During my journey in real estate, I’ve learned that it’s not just about buying properties; it’s about understanding the market dynamics and leveraging them to our advantage. For instance, if we invest solely in residential properties, we may find ourselves vulnerable to fluctuations in the rental market or changes in local housing demand. By incorporating commercial properties into our portfolio, we can tap into different revenue streams, such as leasing office space or retail units, which often come with longer leases and more stable income.

Additionally, we should consider geographical diversification. Investing in various locations within Southwest Florida, or even branching out into neighboring regions, can help us spread the risk associated with economic downturns or local issues. By actively researching and identifying emerging neighborhoods or undervalued areas, we can position ourselves ahead of the curve, ensuring our portfolio is not only diversified but also primed for growth.

Long-Term Growth Strategies for Your Real Estate Portfolio

Creating a successful real estate portfolio is not just about immediate gains; it’s about establishing a foundation for long-term growth. One effective strategy that we can adopt is the buy-and-hold approach. This involves purchasing properties with the intention of holding onto them for several years, allowing us to benefit from property appreciation and rental income over time. In Southwest Florida, where property values can steadily increase due to population growth and economic development, this approach can yield substantial returns.

Another strategy to consider is value-added investments. This is where we look for properties that require some level of improvement or renovation. By purchasing a property below market value and investing in upgrades, we can significantly increase its worth and rental potential. This not only enhances our portfolio’s overall value but also allows us to create a more attractive offering for potential tenants. In a market like Southwest Florida, where demand for quality rental properties is high, this strategy can yield impressive results.

It’s essential to keep an eye on market trends and economic indicators. Regularly analyzing market data allows us to make informed decisions about when to buy, sell, or hold properties within our portfolio. Our ability to adapt to changing market conditions is what sets successful investors apart from the rest. By being proactive and staying educated, we ensure that our portfolio remains resilient and capable of weathering any storms.

The Role of SWFL Commercial Group in Portfolio Management

At SWFL Commercial Group, we understand that managing a real estate portfolio can be overwhelming, especially for those who are new to the investment game. That’s why we offer comprehensive services designed to assist investors at every stage of their journey. Our team of experienced professionals is dedicated to providing the insights and expertise necessary to build and manage a successful portfolio. We take the time to understand our clients’ unique goals and help them identify the best investment opportunities that align with their vision.

Our approach is rooted in collaboration. We believe that by working together, we can develop tailored strategies that not only enhance the value of our clients’ portfolios but also foster growth and sustainability. Whether you’re looking to expand your existing portfolio or just starting to dip your toes into the world of real estate investing, we are here to guide you every step of the way. We leverage our extensive network and deep knowledge of the Southwest Florida market to provide our clients with exclusive access to properties that may not be available to the general public.

Additionally, our commitment to ongoing support doesn’t stop at the acquisition of properties. We also offer property management services, ensuring that your investments are well-maintained and yielding optimal returns. By taking care of the day-to-day operations, we allow you to focus on your broader investment strategies without the stress of property management. With SWFL Commercial Group by your side, you can rest assured that your real estate portfolio is in capable hands.

As we continue to grow and evolve in the dynamic Southwest Florida market, we invite you to partner with us at SWFL Commercial Group. Our passion for real estate, combined with our commitment to your success, ensures that together, we can build a portfolio that not only meets your financial goals but also supports your long-term aspirations.